The Cornwall and Area real estate market has been hot for over 10 months now and by the looks of the current trend, it will just get hotter for the spring market. Prices are increasing at an unprecedented rate. Whether you are getting ready to purchase your first home or considering selling your current house to purchase a new one, there are some basic steps that every borrower can follow in order to prepare for finding the perfect mortgage. We will look at Pre-approvals, Down Payments, and Credit Scores.

PRE-APPROVALS

You have probably heard the term “pre-approval”. Real Estate agents will often ask home buyers if they are pre-approved. This term is deceiving. In most cases, a home buyer actually has a “rate hold” instead of a “pre-approval”. The only way to be sure if you have a pre-approval is if your Mortgage Broker has collected, examined, and verified all of the required income and down payment documentation (and current mortgage information in the case of a sale and purchase).

In our current market, many properties are receiving multiple offers significantly higher than the listing price. You may hear your real estate agent refer to “cash” offers. This refers to an offer or Agreement of Purchase and Sale (APS) that has been submitted on a property that has no conditions. Even with a pre-approval, a lender will still have to approve the property that you choose so a “Condition of Financing” will be necessary on your offer. In addition, if you have a property to sell in order to have enough money for your down payment, your real estate agent will also include a condition on your offer that states your offer is conditional on the sale of your current property. Putting in an offer with no conditions is very risky if you are counting on being approved for a mortgage. There are ways to make it possible but you must make sure you have the options in writing from your Mortgage Broker before you take this drastic step.

It is wise to see a Mortgage Broker at least 6 months before the date that you would like your mortgage to close. Usually, if there are any issues that need to be tidied up, 6 months will allow the time needed to collect the correct documentation and make a mortgage application stronger. Once all of your documentation is verified, a Mortgage Broker can advise you on the appropriate purchase price that you would realistically qualify for.

A good Mortgage Broker will make sure you understand the monthly mortgage payment amounts. You will be made aware of other monthly costs, such as Property Taxes, Water taxes, Insurance, and Utilities, to get a more accurate picture of the true cost of owning a home. It’s better to be prepared than surprised when it comes to owning a home!!

DOWN PAYMENTS AND CLOSING COSTS

The amount of down payment required depends on the specific deal. Generally, if you are purchasing a personal home or a duplex that you are going to live in, you can apply for a mortgage of up to 95% of the purchase price (5% down payment). Triplex and fourplex properties (in which you will live), require at least 10% of the purchase price for the down payment. If you are purchasing any property that will be solely used as a rental income property, then you will require a minimum of 20% down payment and, in some cases, 25% down payment. A property with more than four units is typically considered a Commercial property. If you have questions about Commercial properties, please feel free to contact me directly.

Keep in mind that when you purchase a property, in addition to proving you have a down payment, you will also need to show the lender that you have enough to pay for the closing costs as well. Typically, closing costs will be around 1.5% of the purchase price but often they can add up to even more. A quick phone call to a lawyer is always a good idea to find out what your closing costs may total.

Down payments can come from your own resources, gifts, existing equity, vendor takebacks (VTBs), and/or the First Time Home Buyer Incentive from the government.

OWN RESOURCES

You can use your Savings accounts, Chequing accounts, RRSPs, Tax-Free Savings Accounts (TFSAs), Stocks, Bonds, and other Investments that are saved in your name. You may notice that I do not mention “cash” as an option…. Lenders require 3 months Statements showing the name of the borrower, the transactions, and the current balance to prove the down payment and closing costs are available. If there are any large deposits (over $1,000 individually or within a week) that are not from a paystub or government, the lenders will ask for a paper trail of where the deposit came from. Some real estate agents will accept cash for the deposits but the amount is limited and the lender may ask for where the cash deposit came from so it is best if you can avoid using actual cash for your down payment.

As a first-time homebuyer, the government allows you to use a large number of your RRSPs without penalty for your down payment. You have 15 years to pay them back or claim 1/15 as income each year on your personal taxes. RRSPs must have been invested for at least 90 days before they can be used to purchase a home.

GIFTS

You are also allowed to have all or some of your down payment gifted to you. The gift must be from a direct relative (grandparent, parent, sibling, child). A gift letter is signed by both parties at the time a mortgage is being applied for. Each lender has its own version of a gift letter. A bank statement showing the exact matching amount of funds deposited into the purchaser’s account is required at least 15 days before the closing date. If the funds are not deposited into your account at least 15 days before the closing date, then the lender will ask for 3 months of bank statements from your family member’s account to prove that the funds are there. I recommend having your gift deposited into your account as soon as possible so that you know it is there and available to you.

A family gift is not just monetary. If you are purchasing a property that currently belongs to your family member, they may choose to gift you the equity in the property rather than money. In this case, your down payment is in the form of a “gift” in value that is specified on your Agreement of Purchase and Sale. In these cases, an appraisal determines the actual value of the property so that the amount of the gift is accurate.

EXISTING EQUITY

During a divorce, a “spousal buyout” allows a spouse, who wants to keep a matrimonial home, get a mortgage for up to 95% of the value of the property in order to pay out an amount owing to the other spouse. The 5% down payment comes from the equity that is already in the house. A fully executed separation agreement, an appraisal, and an Agreement of Purchase and Sale that specifies how much equity is remaining with the spouse keeping the house are required for this process. Including a Mortgage early in the Separation process can help ease you through this horrible experience.

VENDOR TAKE BACK (VTB)

On very rare occasions, lenders will allow the party selling the property to give a second mortgage to the party buying a property to help with increasing the down payment amount. This second mortgage is called a Vendor Take Back. It is a very complicated option and is difficult to have approved by any major lender. You would definitely want to have a Mortgage Broker involved at all stages of this option.

FIRST TIME HOME BUYER INCENTIVE

If you can provide your 5% down payment and you qualify for the Incentive, then the Government of Canada provides 5% down payment for a first-time buyer’s purchase of an existing home. Rules are different for newly constructed homes. The Incentive is registered by your lawyer as a lien on your property but there are no monthly payments.

1. You can repay the Incentive at any time in full without a pre-payment penalty.

2. You have to repay the Incentive after 25 years or if the property is sold, whichever happens first.

3. The repayment amount of the Incentive is based on the property’s fair market value. If your Incentive amount was 5% of your purchase price, then you would have to pay the government 5% of the current market value of your property at the time you sell and/or pay it back.

NOTE: If your property value goes down, you still only repay 5% of the current market value at that time of repayment. The government will share the loss!

In order to be eligible for the Incentive, you must be a first-time homebuyer.

That means you either:

- Have never owned real estate or

- Have not owned a home in at least the last 4 years or

- Are recently divorced/separated

- You need to have the minimum down payment

- 5% for a single-family home or owner-occupied duplex

- 10% for an owner-occupied triplex or fourplex

- Your maximum qualifying income (combined for all applicants) can be no more than $120,000 (gross income)

- Your total mortgage amount can only be up to 4 times the qualifying income (maximum mortgage amount $480,000)

- Investment properties are not eligible

- The total of your down payment and the Incentive add up to less than 20% of the purchase price (it has to be a qualified, insured CMHC, Genworth, or Canada Guaranty mortgage)

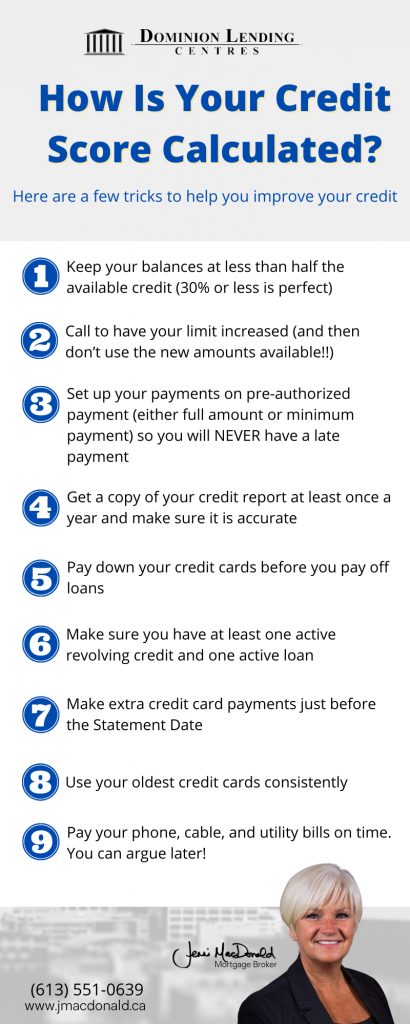

YOUR CREDIT SCORE IS YOUR POWER WHEN APPLYING FOR A MORTGAGE

With all the recent mortgage changes, your credit score is more important than ever. Most Lenders rely on the “Equifax” score. Equifax calculates a credit “risk” score out of a maximum score of 900. A score of 700 or higher is considered an excellent score and opens the doors to better interest rates and bank approvals. If you have used Creditkarma.ca to find out your score, you are accessing a TransUnion score based on 6 months of history which is not currently used by many lenders but it will give you an idea of the status of the accounts showing on your credit bureau are accurate.

Let’s look at the factors that determine your credit score.

1. PAYMENT HISTORY determines about one-third of your score. Even a one-day late payment can negatively influence your score and shows on your bureau for 6 years. It’s more important to pay the minimum payment on time than to pay a larger amount late. Setting up all your accounts on pre-authorized payments for the minimum amount will ensure that you will never have a late payment.

The MOST important credit advice is to avoid having anything sent to COLLECTIONS. No lender will provide a mortgage to someone with an unpaid collection. Each one decreases your score by about 80 points. If you are having a dispute with your cell phone or internet provider, pay the bill and then argue about it later!!!

2. AMOUNT OF CREDIT USED is another large factor in determining your credit score. The more of the credit you have used, the lower your score will be. Keeping your balance under 30% of the total available amount will help your score increase. If you are in a hurry to improve your score, consider calling your credit companies for a limit increase. The secret to this trick is to NOT use the increase once it is applied!!

3. AGE OF YOUR ACCOUNTS is more important than you may be aware. Lenders will want to see at least 2 different kinds of credit established for at least 2 years for a total limit of at least $2,500. If you are considering closing any of your current credit, make sure you never close your oldest credit card. Be aware that if you close an account, your score could drop by almost 100 points!!

4. TYPE OF CREDIT you have affects your score. A combination of credit cards, loans, and lines of credit are desirable. Since Lines of Credit are the most difficult types of credit to acquire and usually offer the lowest interest rate, you may want to make sure you always keep one open for future emergencies.

5. NUMBER OF ENQUIRIES on your credit in the last 36 months will affect your score. Numerous calls looking for credit from different companies are a red flag for lenders and will lower your score.

If you are interested in finding out more, I’d be happy to look at your mortgage options with you.