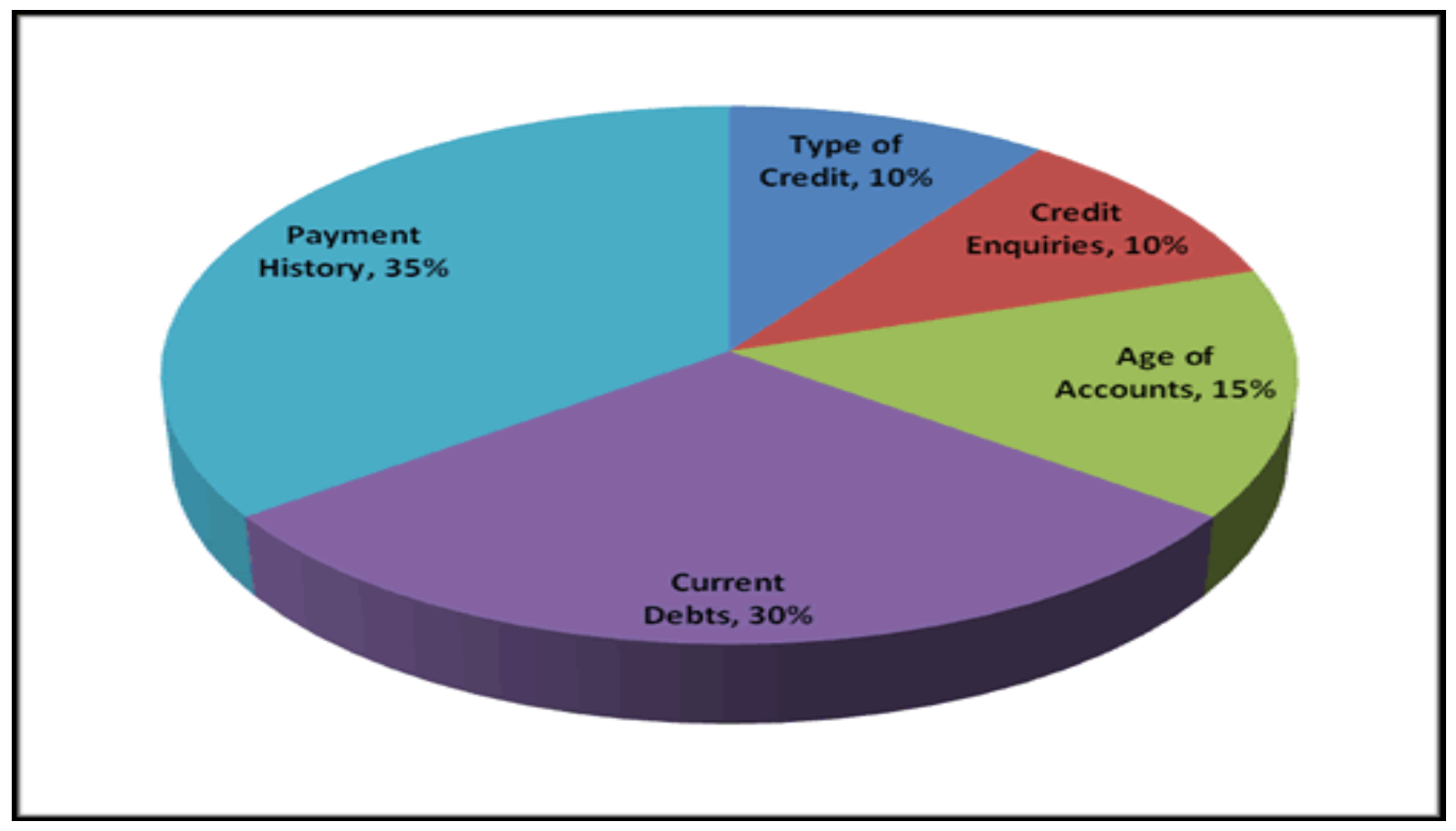

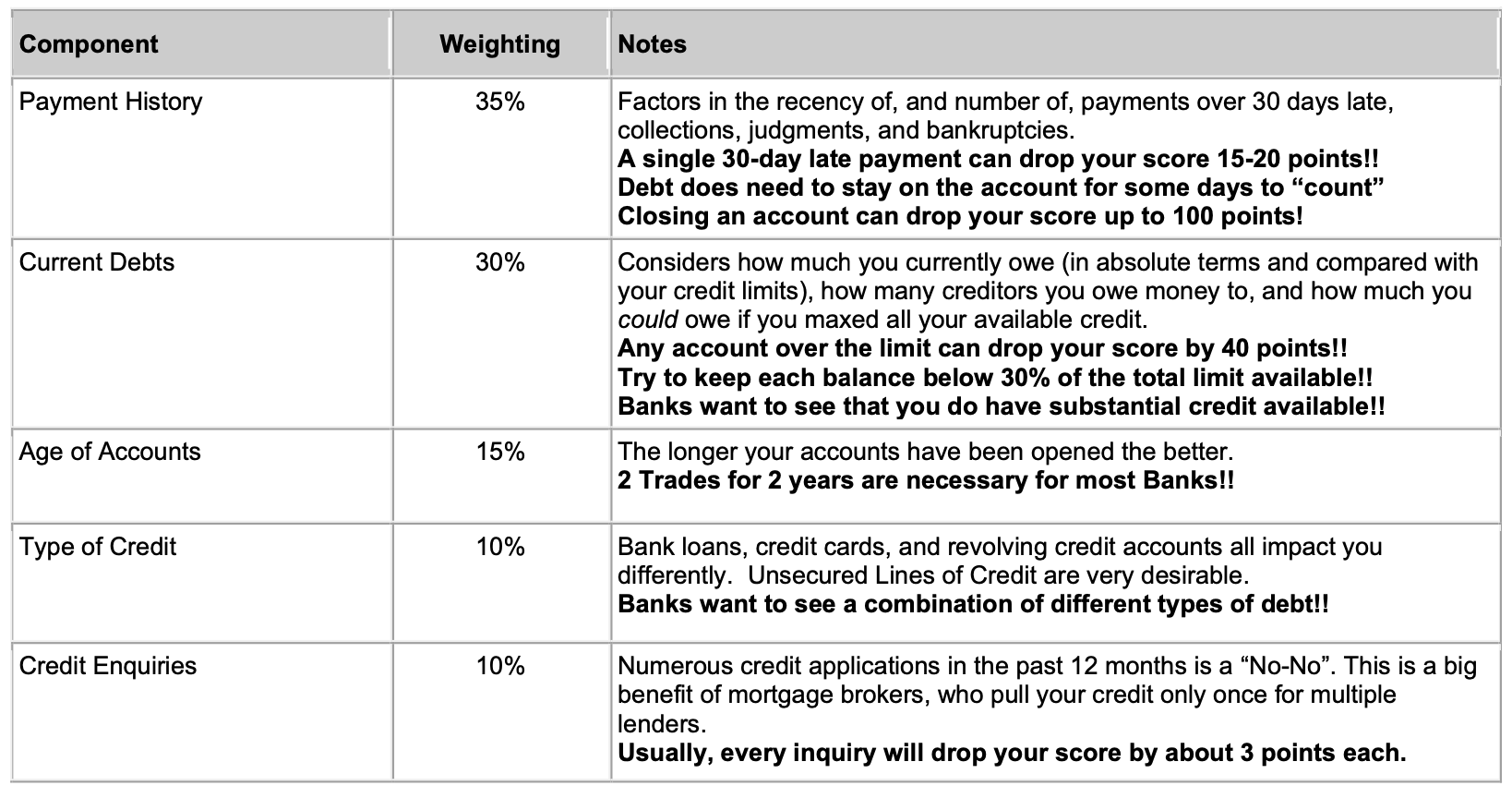

The Equifax Credit Score uses a numerical range of 280 to 900, where higher scores indicate lower credit risk. Banks will want clients to be at a score of 700 or higher!! While no one knows the exact formula (except the inventor, Fair Isaac Corporation), Beacon scores are roughly based on:

Here are a few tricks to help you improve your credit quickly:

- Keep your balances at less than half the available credit or less (30% or less is perfect)

- Call to have your limit increased (and then don’t use the new amounts available!!)

- Set up your payments on pre-authorized payment (either full amount or minimum payment) so you will NEVER have a late payment

- Get a copy of your credit report at least once a year and make sure they are accurate (Creditkarma.ca is free and has an app)

- Pay down your credit cards before you pay off loans

- Make sure you have at least one revolving credit and one loan

- Make extra credit card payments just before the “Statement Date”

- Use your oldest credit cards consistently

- Pay your phone, cable and utility bills on time. You can argue later!

If you are wondering about your score and what you can do to improve it, please feel free to call, email or text me anytime. I can show you your bureau and where we can make some improvements – at no charge!!!

For more information on Credit Scores visit https://jmacdonald.ca/mortgage-tips/credit-scores-score/